The 5-Minute Rule for The Modern Medicare Agency

Solutions differ based upon an individual's degree and also sort of requirement. Services can be short-term, while recouping from an injury or ailment, or lasting for lots of years, and also can vary from straightforward checks to a lot more thorough solutions. Solutions in your area may include meals, transport or aid handling persistent conditions.

The Definitive Guide to The Modern Medicare Agency

Medicare generally doesn't pay for long-term treatment. Medicare will aid pay for knowledgeable nursing or home wellness care if you satisfy particular problems in link with a health center keep.

Long-term care insurance coverage can help spend for lasting treatment expenses (https://checkyobizlist.com/insurance-agency/the-modern-medicare-agency-melville-new-york/). Lasting care insurance might not be suitable for every person. Visit the Oregon Insurance Department site for help deciding if long-lasting treatment insurance coverage is right for you. Oregon Job Freedom is a program developed to aid individuals stay in their homes who do not receive Medicaid long-term treatment services.

The Only Guide for The Modern Medicare Agency

Those who meet solution eligibility requirements will have access to: APD lasting solutions and also supports which consist of aid with tasks of day-to-day living, such as flexibility, consuming, toileting and also sustains relevant to cognitive concerns - Medicare Agent Huntington NY. Oregon Health insurance advantages will certainly not be considered Public Charge decisions, however there is an exemption for individuals receiving long-lasting treatment in nursing facilities or mental health establishments.

There are several programs that might supply support, each with different qualification requirements. Solutions can be given in a person's home or in a treatment setup.

The Of The Modern Medicare Agency

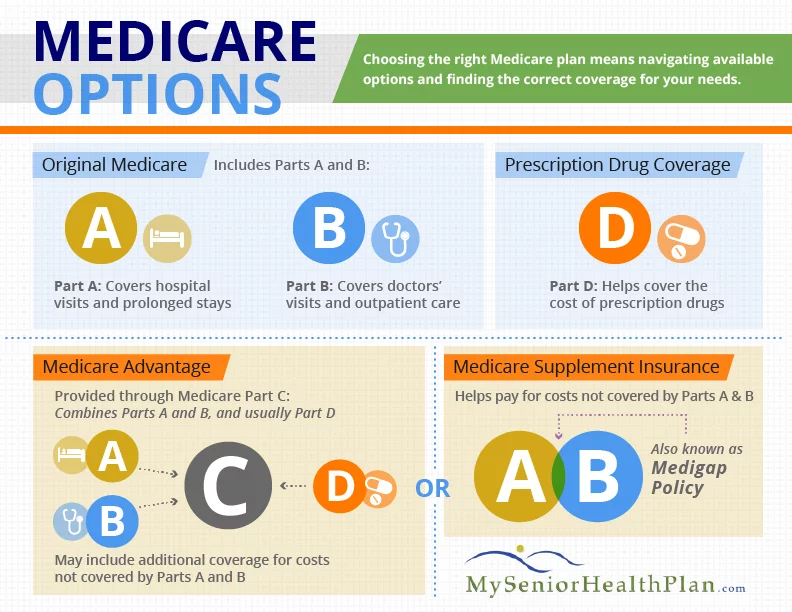

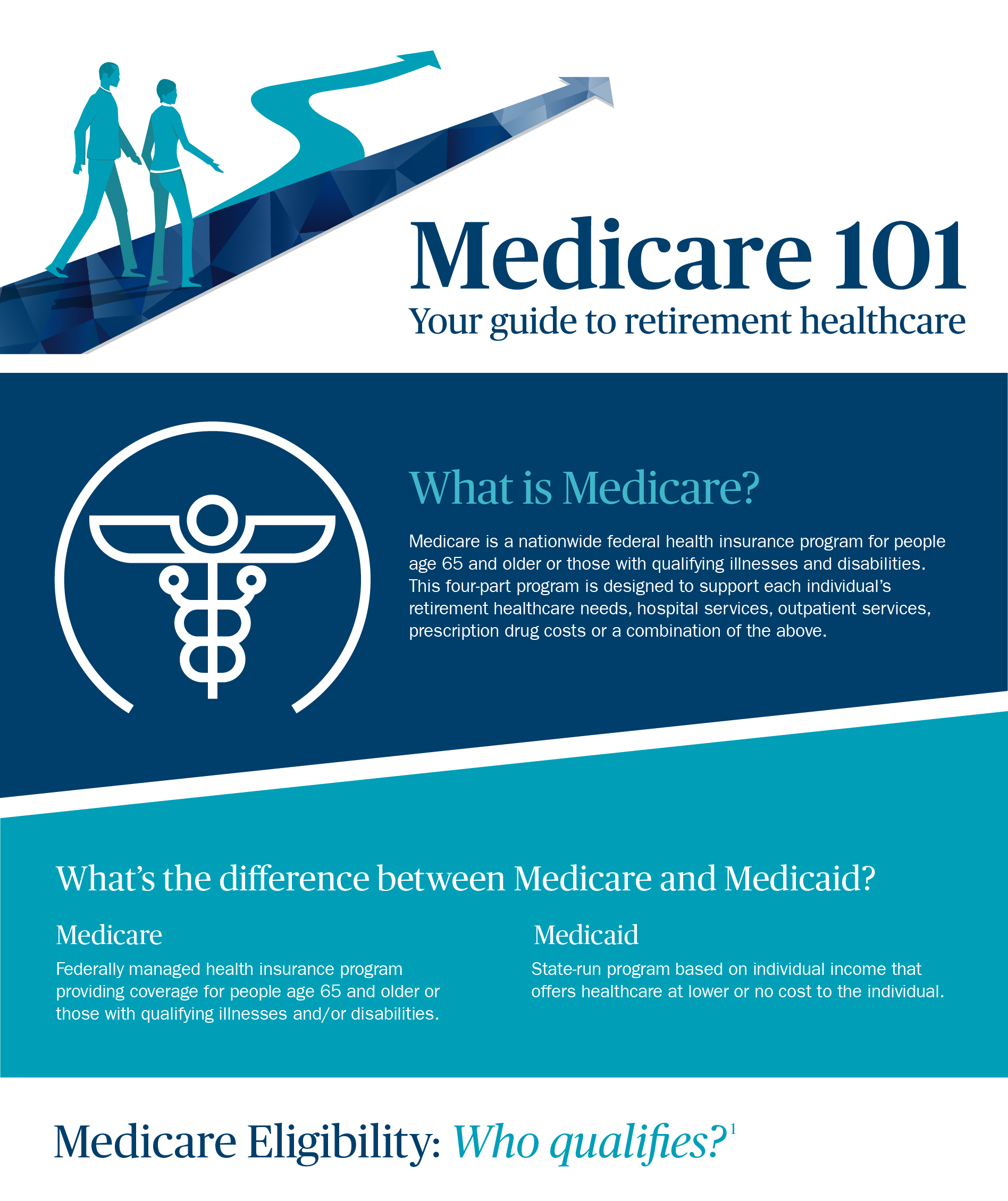

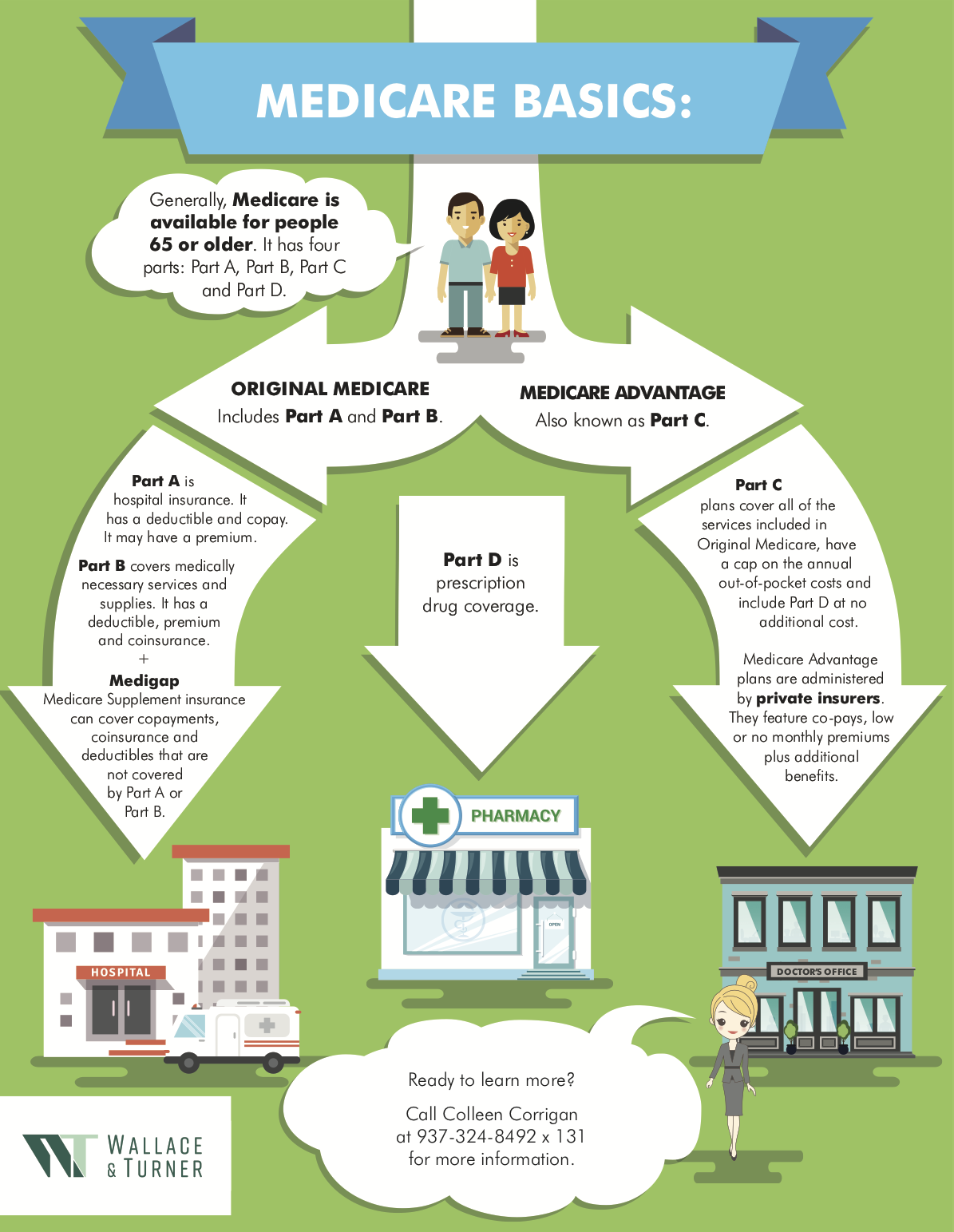

Recognizing the basics of Medicare as well as exactly how it functions will aid lay the structure you need to choose concerning your Medicare coverage choices. This article describes Medicare Part A (medical facility insurance coverage). Medicare Component A becomes part of Initial Medicare (together with Component B), the government-sponsored health insurance program for those that certify by age, impairment, or specific wellness conditions.

Most of those who get Medicare are instantly signed up in the program. For even more information concerning qualification, see Medicare Qualification. The majority of people do not have to pay a costs for Medicare Part A. If you or your spouse operated at the very least one decade (40 quarters) as well as paid Medicare taxes while working, you'll obtain premium-free Component A.

Not known Incorrect Statements About The Modern Medicare Agency

Medicare Part A is health center insurance coverage provided by Medicare through the Centers for Medicare & Medicaid Providers - Medicare Agent Huntington NY. Component An insurance coverage consists of (but might not be limited to) inpatient care in medical facilities, nursing homes, proficient nursing centers, and also vital accessibility healthcare facilities. Component A does not consist of long-term or custodial treatment. If you meet certain demands, then you might likewise be eligible for hospice or limited residence wellness care.

The 7-Second Trick For The Modern Medicare Agency

You do not require to submit Medicare Part A declares as a beneficiary. Medicare Component A is mostly hospital insurance. For protection of physician sees and clinical services and products, see Medicare Component B. Component A helps cover the solutions provided below when medically required and also supplied by a Medicare-assigned health-care service provider in a Medicare-approved facility.

The healthcare facility gets blood from a blood financial institution at no fee, so if you receive blood as component of your inpatient keep you won't have to pay for it or replace it - https://primebizdirectory.com/insurance-agency/the-modern-medicare-agency-melville-new-york/. If the facility has to get blood for you, usually you need to spend for the first 3 units you get in a fiscal year or have it donated.

Indicators on The Modern Medicare Agency You Should Know

Medicare Part A typically covers hospital stays, consisting of a semi-private space, meals, basic nursing, as well as specific health center solutions and also products. Component A might cover inpatient treatment in: Essential accessibility medical facilities Inpatient rehab facilities Severe care hospitals Qualifying medical pop over to this site research studies Long-term treatment medical facilities Psychological health centers (as much as a 190-day lifetime maximum) Medicare Part A covers this care if all of the following are true: A doctor orders clinically necessary inpatient care of a minimum of 2 nights (counted as twelve o'clock at nights) - Local Medicare agent.

You require care that can only be provided in a healthcare facility. The medical facility's Utilization Testimonial Committee authorizes your stay. Medicare Component A covers limited treatment in a skilled nursing center (SNF) if your scenario meets a variety of standards: You've had a "certifying inpatient health center remain" of a minimum of three days (72 hours).

Not known Factual Statements About The Modern Medicare Agency

The SNF is Medicare-certified. Your medical professional has determined you need skilled nursing care every day. This treatment needs to originate from (or be straight monitored by) proficient nursing or therapy staff. You have not used all the days in your benefit duration. (According to Medicare, this duration starts the day you're admitted to an SNF or a healthcare facility as an inpatient, as well as finishes when you have not had inpatient treatment or competent nursing look after 60 successive days.) You call for proficient nursing services either for a hospital-related medical condition, or a health condition that started when you were obtaining SNF take care of a hospital-related clinical condition.

Intend your medical facility stay was for a stroke as well as your physician determined that a nursing house or experienced nursing facility was clinically necessary for your healing. In that instance, Medicare might cover a retirement home or experienced nursing center stay for rehabilitation. A nursing house or proficient nursing center keep includes a semi-private room, meals, and rehabilitative as well as knowledgeable nursing services and treatment.

A Biased View of The Modern Medicare Agency

The very first 20 days are paid completely, and the remaining 80 days will need a copayment. Medicare Component A will not cover long-term care, non-skilled, day-to-day living, or custodial tasks. Specific healthcare facilities and also crucial gain access to healthcare facilities have contracts with the Division of Health And Wellness & Human Services that allows the medical facility "swing" its beds into (and out of) SNF treatment as needed.